Forex trading, a dynamic and constantly evolving business, is often viewed as a lucrative and exciting opportunity for traders around the globe. It involves the exchange of currencies in the foreign exchange market, which is the largest financial market in the world. For those looking to dip their toes into this arena, platforms like forex trading business Indian Trading Platforms offer accessible resources and tools. This article delves into the essential aspects of the Forex trading business, from basic concepts to advanced strategies, to equip aspiring traders with the knowledge they need to succeed.

The Basics of Forex Trading

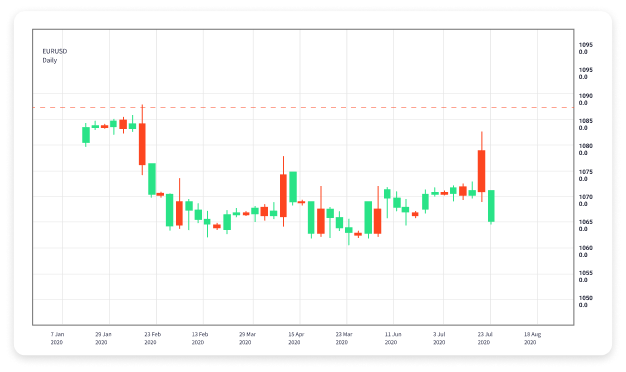

At its core, Forex trading is about buying one currency while simultaneously selling another. Currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The first currency in the pair is known as the base currency, and the second is the quote currency. The goal of traders is to speculate on the movement of these currency pairs; if a trader believes that the base currency will appreciate against the quote currency, they will initiate a buy order. Conversely, if they believe the base currency will depreciate, they will sell.

Understanding Currency Pairs

Currency pairs are categorized as major, minor, or exotic. Major pairs, such as EUR/USD, USD/JPY, and GBP/USD, are the most traded and tend to have the highest liquidity. Minor pairs, like AUD/NZD or EUR/GBP, involve currencies from smaller economies and are generally less liquid. Exotic pairs, such as USD/SGD (US Dollar/Singapore Dollar) or EUR/TRY (Euro/Turkish Lira), involve a major currency paired with a currency from an emerging market.

Factors Affecting Forex Prices

The Forex market is influenced by a myriad of factors, both economic and geopolitical. Economic indicators, such as interest rates, inflation rates, and employment figures, play a significant role in shaping currency value. Central banks, through their monetary policies, also have a profound impact on foreign exchange rates. For instance, if a central bank raises interest rates, it could lead to an appreciation of the respective currency as higher rates attract foreign capital.

Technical vs. Fundamental Analysis

Traders often rely on two primary methods of analysis to guide their trading decisions: technical analysis and fundamental analysis. Technical analysis involves analyzing price charts and using indicators to predict future price movements based on historical data. Traders may look for patterns, trends, and price levels to identify potential entry and exit points.

On the other hand, fundamental analysis involves evaluating economic indicators, news events, and geopolitical developments to determine the intrinsic value of a currency. Both methods have their merits and can be combined for a more comprehensive trading strategy.

Trading Strategies for Success

Developing a trading strategy is crucial for long-term success in the Forex trading business. Here are some popular strategies that traders often employ:

- Day Trading: This strategy involves making short-term trades and closing positions within the same day to capitalize on small price movements.

- Swing Trading: Swing traders hold positions for several days or weeks, aiming to profit from price swings and market fluctuations.

- Scalping: Scalpers make numerous quick trades throughout the day, seeking to gain small profits from minor price changes.

- Position Trading: This long-term strategy involves holding trades for months or even years, based on fundamental analysis.

The Role of Leverage in Forex Trading

Leverage is a double-edged sword in Forex trading. It allows traders to control a larger position with a smaller amount of capital, magnifying both potential profits and losses. For example, with a leverage ratio of 100:1, a trader can control $100,000 worth of currency with just $1,000 in their trading account. While this can lead to significant profits, it also exposes traders to the risk of substantial losses. Thus, managing leverage wisely is paramount.

Risk Management: Protecting Your Capital

Effective risk management is essential for any Forex trader. Without a proper risk management strategy, traders may find themselves exposed to significant losses. Here are key strategies for managing risk:

- Setting Stop Loss Orders: A stop-loss order automatically closes a trade at a predetermined price, limiting potential losses.

- Position Sizing: Traders should determine the appropriate position size based on their account balance and risk tolerance.

- Diversification: Spreading trades across different currency pairs can reduce the overall risk of a trader’s portfolio.

- Emotional Discipline: Traders must maintain emotional discipline, avoiding impulsive decisions based on fear or greed.

Choosing the Right Broker

Selecting a trustworthy Forex broker is critical for successful trading. Traders should consider several factors when choosing a broker, including regulatory compliance, trading platform features, fees, spreads, and customer service. A reputable broker will provide access to robust trading tools, educational resources, and a user-friendly platform that meets the trader’s needs.

Staying Informed: Continuous Learning and Adaptation

The Forex market is ever-changing, and staying informed about market trends, economic developments, and trading strategies is essential. Traders should seek continuous education through webinars, online courses, and reputable financial news sources. Keeping a trading journal can also help traders reflect on their performance and improve their strategies over time.

Conclusion

Embarking on a Forex trading journey can be an exhilarating yet challenging endeavor. Success in the Forex trading business requires a solid understanding of market fundamentals, effective strategies, and robust risk management practices. By continuously learning and adapting to the market’s fluctuations, traders can position themselves for long-term success. Whether you are a novice or an experienced trader, leveraging platforms such as Indian Trading Platforms can provide valuable resources to enhance your trading experience and knowledge.